Yes. If you file for Chapter 7 bankruptcy, your nonexempt assets will be liquidated to repay your creditors. These include all personal items that are not necessary for your daily life, such as personal electronics and jewelry. Conversely, exempt items – integral to your day-to-day life or your occupation – are safeguarded. These often include your household goods, your home, your vehicle, and any items you need to perform your job.

Reclaiming Financial Freedom

Your Path to a Debt-Free Future

NWI Bankruptcy Attorneys

Can Help Stop the Craziness.

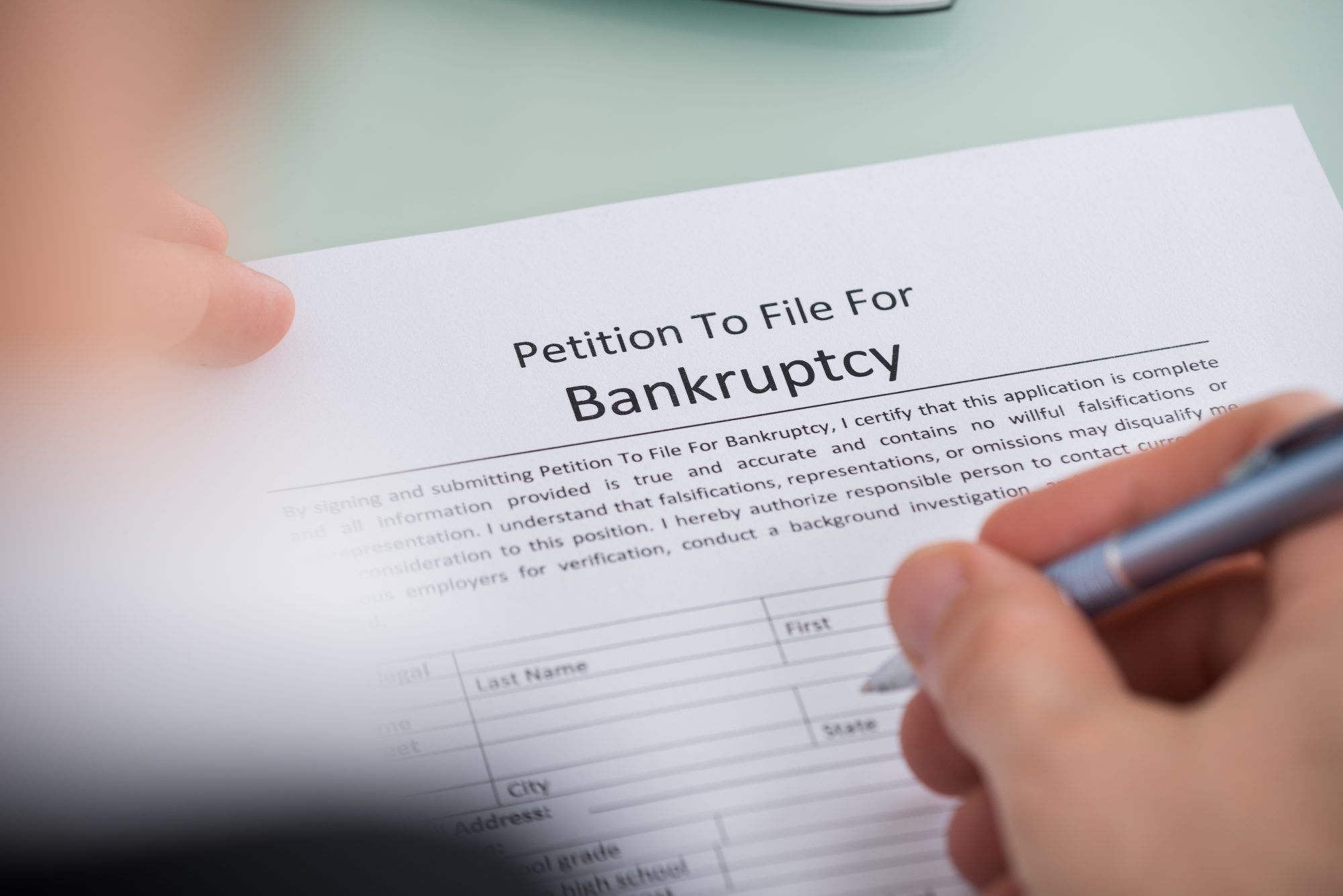

Most people think of bankruptcy as a very negative situation. However, while it is true that no one ever wants to go through bankruptcy, the fact is sometimes it’s necessary. Many times, bankruptcy can help a person get back on track financially and assist him or her with starting a more fiscally responsible way of life. Despite the negative financial aspects that lead a person to file for bankruptcy, there are actually some benefits to choosing this option.

Can Bankruptcy Really be Helpful?

So, how can bankruptcy help you? First and foremost, bankruptcy can help relieve the burden of debt. If you’re in debt, then you already understand how difficult that burden can be. Debt is like a constant weight attached to your back that never sleeps and follows you wherever you go. In certain situations, debt can even take over your life and encompass every decision you make. If you’re feeling the unstoppable weight of debt, then you should consider bankruptcy.

Northwest Indiana Bankruptcy Process

- Consultation

- Chapter

7 or 13 - Fill Out Forms

- Credit Counseling

- Automatic

Stay - Confirmation Hearing

- Final Discharge of Debts

Consultation

Your first step is to contact our firm to schedule an initial consultation with our bankruptcy attorney at your convenience.

Frequently Asked

Questions

Does My Spouse Have to File Jointly with Me?

No, the Bankruptcy Code does not require married couples to file together. If most of the debt is in your name only, you can file your bankruptcy case alone. Certain debts, like medical bills and debts made in both spouses’ names, are both parties’ responsibility. In cases like this, it can be beneficial for spouses to file their bankruptcy jointly.

Who Knows About My Personal Bankruptcy Case?

Only you, the court, and anybody you choose to tell about the bankruptcy will know about your case. Although bankruptcy filings are public records, it is rare for parties outside a case to seek this information.

Will I Be Able to Rent After I File for Personal Bankruptcy?

Yes. However, it can be difficult to have a lease application accepted if you have bad credit and a bankruptcy case on your credit history. Reducing your personal debt through bankruptcy can actually help you secure a lease in some cases—by removing your debt, you can appear to be a better credit risk than other applicants.

How Do I Know if I Should File for Personal Bankruptcy?

If you have a level of personal debt that you cannot realistically repay on your own, bankruptcy might be the right course of action. If you are facing threatening collection calls, wage garnishment, foreclosure on your home, or repossession of your vehicle, filing for bankruptcy can stop these actions.

Meet The Attorneys

why choose

whitten & whitten

established legal relationships

Our attorneys have cultivated strong working relationships with judges and peers, offering you an advantage in court proceedings.

over 30 years of experience

We bring three decades of experience in addressing diverse legal needs.

personalized service

Every client receives individualized, one-on-one attention.

flexible payment plans

We provide various payment options to ease your financial concerns.

streamlining bankruptcy

Our approach makes the bankruptcy process as straightforward and stress-free as possible.

accessibility

We’re here for you with evening & weekend appointments to fit your schedule.

complimentary case evaluation

Start with a free review of your options to make informed decisions.

What Our Clients Say!

These guys really took me out of a tough time. Really down to earth and made me feel at easy. Would recommend

Mark H.

I would suggest Whitten & Whitten and the whole office. They helped me and were so helpful and friendly. Thank you for getting me back on track.

Patti B.

Recent Blogs

How Much Debt Do I Need to File for Bankruptcy?

Do You Get Out of All Debts if You Declare Bankruptcy?

If I File for Bankruptcy, Can I Keep My Car?

How Can I Avoid Foreclosure on my House in Indiana?

Will Bankruptcy Affect My Taxes?

How Long Does an Indiana Bankruptcy Take?

Get Started Today.

Contact Us

If you are ready to speak to an attorney, provide the information

below for a free initial consultation.